Can non custodial parent claim child as dependent best sale

Can non custodial parent claim child as dependent best sale, Determining Household Size for Medicaid and the Children s Health best sale

$76.00

SAVE 50% OFF

$38.00

$0 today, followed by 3 monthly payments of $12.67, interest free. Read More

Can non custodial parent claim child as dependent best sale

Determining Household Size for Medicaid and the Children s Health

IS YOUR EX SPOUSE IMPROPERLY CLAIMING YOUR CHILDREN

What Happens When Both Parents Claim a Child on a Tax Return

Custodial Parent Child Tax Credit and Divorce or Separation

Which Divorced Parent Gets to Claim the Kids in Minnesota Taxes

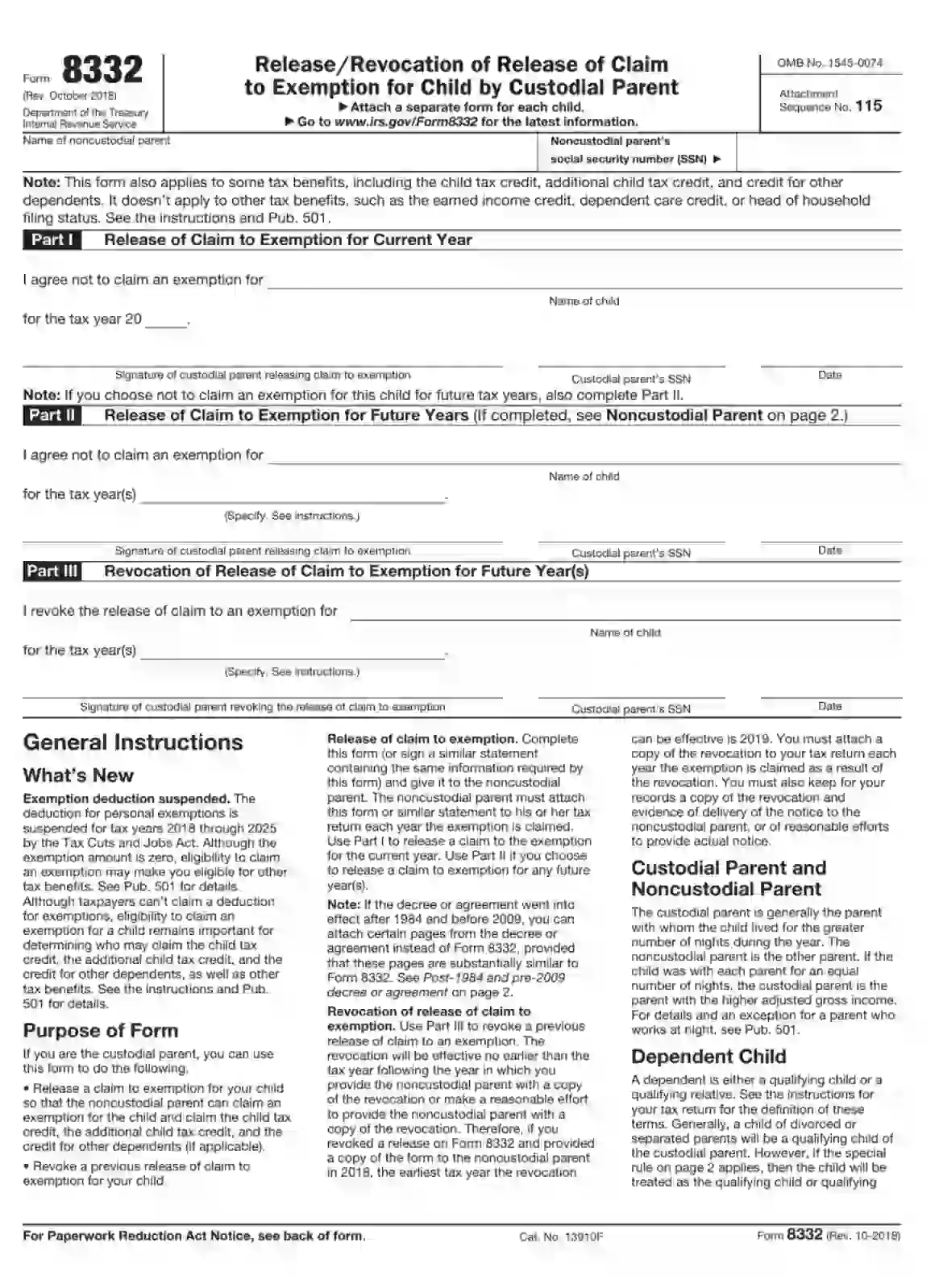

IRS Form 8332 Fill Out Printable PDF Forms Online

Description

Product Name: Can non custodial parent claim child as dependent best sale

When Someone Else Claims Your Child As a Dependent best sale, Custodial Parent Child Tax Credit and Divorce or Separation best sale, Can a Non Custodial Parent Claim a Child on Taxes best sale, What is the Tax Dependency Exemption and Who Should Get It best sale, Child Tax Credit How it affects joint custody arrangements best sale, Dependency Exemptions for Separated or Divorced Parents White best sale, Who Claims A Child On Taxes When There Is Shared Custody best sale, Form 8332 IRS Tax Forms Jackson Hewitt best sale, Custodial Parent Child Tax Credit and Divorce or Separation best sale, Who Gets to Claim a Child as Dependent When the Parents Are best sale, IRS Form 8332 How Can I Claim a Child The Handy Tax Guy best sale, Determining Household Size for Medicaid and the Children s Health best sale, IS YOUR EX SPOUSE IMPROPERLY CLAIMING YOUR CHILDREN best sale, What Happens When Both Parents Claim a Child on a Tax Return best sale, Custodial Parent Child Tax Credit and Divorce or Separation best sale, Which Divorced Parent Gets to Claim the Kids in Minnesota Taxes best sale, IRS Form 8332 Fill Out Printable PDF Forms Online best sale, Can I Claim My Parents or an Adult Child as Dependents SH Block best sale, Which Parent Can Claim Child As A Dependent Law Office of Louis best sale, Custodial parent head of household filing status credit for best sale, Texas Medical Child Support Order Letter To Non Custodial Parent best sale, Custodial Parent Child Tax Credit and Divorce or Separation best sale, WHO GETS TO CLAIM THE DEPENDENCY TAX EXEMPTION IN THEIR TAX RETURN best sale, Do You Have to Claim Child Support on Taxes best sale, What is Form 8332 Release Revocation of Release of Claim to best sale, Orange County After a Divorce Who Can Claim the Child as best sale, What would you do if your child s father who has no rights to the best sale, What Rights Do I Have As A Non Custodial Parent best sale, Question of the Day Dependents for Premium Tax Credits best sale, Can Both Parents Claim Their Child on Taxes best sale, 1 Money Talks Have You Heard Promote the Earned Income Credit best sale, PPT Household Composition PowerPoint Presentation free download best sale, Child dependency claims by noncustodial parents Journal of best sale, What Is Form 8332 H R Block best sale, Who Claims the Kids on Taxes in Texas After a Divorce best sale.

When Someone Else Claims Your Child As a Dependent best sale, Custodial Parent Child Tax Credit and Divorce or Separation best sale, Can a Non Custodial Parent Claim a Child on Taxes best sale, What is the Tax Dependency Exemption and Who Should Get It best sale, Child Tax Credit How it affects joint custody arrangements best sale, Dependency Exemptions for Separated or Divorced Parents White best sale, Who Claims A Child On Taxes When There Is Shared Custody best sale, Form 8332 IRS Tax Forms Jackson Hewitt best sale, Custodial Parent Child Tax Credit and Divorce or Separation best sale, Who Gets to Claim a Child as Dependent When the Parents Are best sale, IRS Form 8332 How Can I Claim a Child The Handy Tax Guy best sale, Determining Household Size for Medicaid and the Children s Health best sale, IS YOUR EX SPOUSE IMPROPERLY CLAIMING YOUR CHILDREN best sale, What Happens When Both Parents Claim a Child on a Tax Return best sale, Custodial Parent Child Tax Credit and Divorce or Separation best sale, Which Divorced Parent Gets to Claim the Kids in Minnesota Taxes best sale, IRS Form 8332 Fill Out Printable PDF Forms Online best sale, Can I Claim My Parents or an Adult Child as Dependents SH Block best sale, Which Parent Can Claim Child As A Dependent Law Office of Louis best sale, Custodial parent head of household filing status credit for best sale, Texas Medical Child Support Order Letter To Non Custodial Parent best sale, Custodial Parent Child Tax Credit and Divorce or Separation best sale, WHO GETS TO CLAIM THE DEPENDENCY TAX EXEMPTION IN THEIR TAX RETURN best sale, Do You Have to Claim Child Support on Taxes best sale, What is Form 8332 Release Revocation of Release of Claim to best sale, Orange County After a Divorce Who Can Claim the Child as best sale, What would you do if your child s father who has no rights to the best sale, What Rights Do I Have As A Non Custodial Parent best sale, Question of the Day Dependents for Premium Tax Credits best sale, Can Both Parents Claim Their Child on Taxes best sale, 1 Money Talks Have You Heard Promote the Earned Income Credit best sale, PPT Household Composition PowerPoint Presentation free download best sale, Child dependency claims by noncustodial parents Journal of best sale, What Is Form 8332 H R Block best sale, Who Claims the Kids on Taxes in Texas After a Divorce best sale.

Can non custodial parent claim child as dependent best sale

- can non custodial parent claim child as dependent

- can nintendo wii u play wii games

- can non custodial parent claim child

- can nose spray cause nose bleeds

- can oculus connect to ps4

- can oculus be used with ps4

- can oculus go connect to ps4

- can oculus quest connect to ps4

- can oculus quest play ps4 games

- can oculus quest be used with ps4