Non custodial parent claiming child best sale

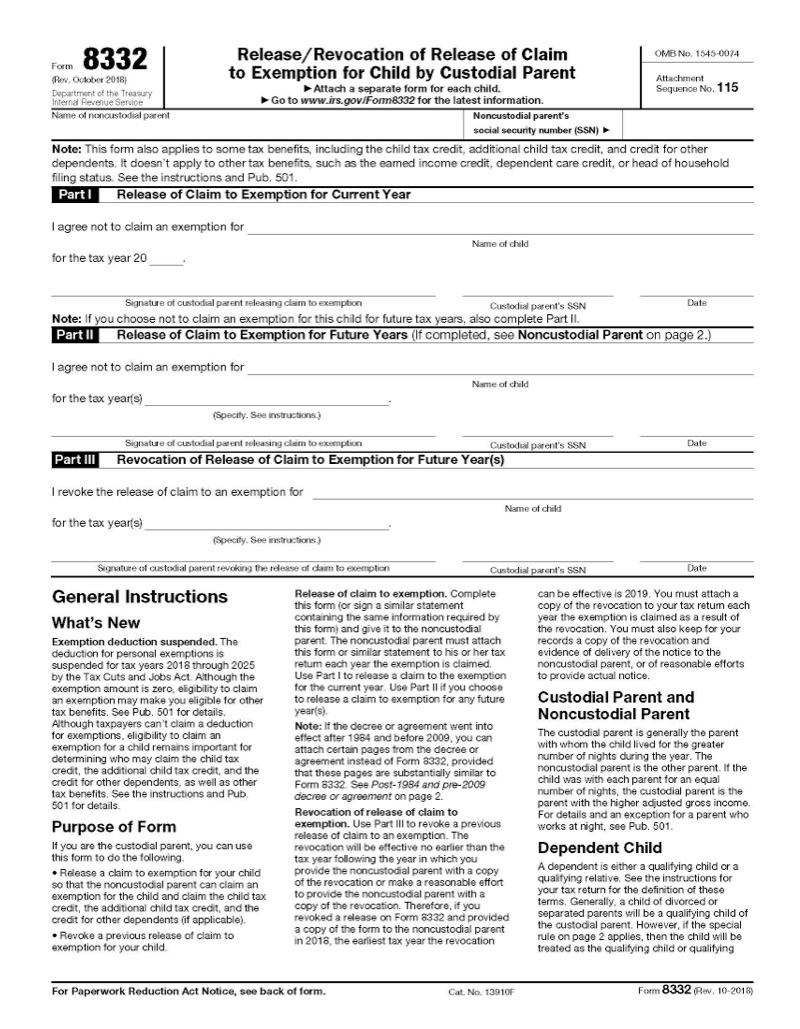

Non custodial parent claiming child best sale, What is Form 8332 Release Revocation of Release of Claim to best sale

$90.00

SAVE 50% OFF

$45.00

$0 today, followed by 3 monthly payments of $15.00, interest free. Read More

Non custodial parent claiming child best sale

What is Form 8332 Release Revocation of Release of Claim to

IRS form 8332. Non Custodial parent can claim child if custodial

What is the Tax Dependency Exemption and Who Should Get It

Who Claims A Child On Taxes When There Is Shared Custody

Which Divorced Parent Gets to Claim the Kids in Minnesota Taxes

Form 8332 IRS Tax Forms Jackson Hewitt

Description

Product code: Non custodial parent claiming child best sale

IS YOUR EX SPOUSE IMPROPERLY CLAIMING YOUR CHILDREN best sale, Can a Non Custodial Parent Claim a Child on Taxes best sale, Child Tax Credit How it affects joint custody arrangements best sale, IRS Form 8332 How Can I Claim a Child The Handy Tax Guy best sale, When Someone Else Claims Your Child As a Dependent best sale, Claiming the Child Tax FasterCapital best sale, IS YOUR EX SPOUSE IMPROPERLY CLAIMING YOUR CHILDREN best sale, Custodial Parent Child Tax Credit and Divorce or Separation best sale, Divorced Parents Guidelines in IRS Publication 972 for Child Tax best sale, Custodial Parent Child Tax Credit and Divorce or Separation best sale, Which Parent Should Claim Child ren on Taxes After a Divorce or best sale, What is Form 8332 Release Revocation of Release of Claim to best sale, IRS form 8332. Non Custodial parent can claim child if custodial best sale, What is the Tax Dependency Exemption and Who Should Get It best sale, Who Claims A Child On Taxes When There Is Shared Custody best sale, Which Divorced Parent Gets to Claim the Kids in Minnesota Taxes best sale, Form 8332 IRS Tax Forms Jackson Hewitt best sale, What Happens When Both Parents Claim a Child on a Tax Return best sale, If I Pay Child Support Can I Claim My Child On Taxes best sale, What is child support and how can I request it AS USA best sale, Dependency Exemptions for Separated or Divorced Parents White best sale, IRS Form 8332 How Can I Claim a Child The Handy Tax Guy best sale, IRS Form 8332 Fill Out Printable PDF Forms Online best sale, Determining Household Size for Medicaid and the Children s Health best sale, Form 8332 In Depth Guide 2024 US Expat Tax Service best sale, Child Tax Credit How it affects joint custody arrangements best sale, Do You Have to Claim Child Support on Taxes best sale, 1 Money Talks Have You Heard Promote the Earned Income Credit best sale, What Rights Do I Have As A Non Custodial Parent best sale, Non Custodial Parent Statement Sample pdfFiller best sale, Non custodial parent form Fill out sign online DocHub best sale, What if I am separated or divorced What if I have joint custody best sale, CP Tax Accounting Services best sale, How to know if you re receiving the right amount of child support best sale, Who Claims the Kids on Their Tax Return best sale.

IS YOUR EX SPOUSE IMPROPERLY CLAIMING YOUR CHILDREN best sale, Can a Non Custodial Parent Claim a Child on Taxes best sale, Child Tax Credit How it affects joint custody arrangements best sale, IRS Form 8332 How Can I Claim a Child The Handy Tax Guy best sale, When Someone Else Claims Your Child As a Dependent best sale, Claiming the Child Tax FasterCapital best sale, IS YOUR EX SPOUSE IMPROPERLY CLAIMING YOUR CHILDREN best sale, Custodial Parent Child Tax Credit and Divorce or Separation best sale, Divorced Parents Guidelines in IRS Publication 972 for Child Tax best sale, Custodial Parent Child Tax Credit and Divorce or Separation best sale, Which Parent Should Claim Child ren on Taxes After a Divorce or best sale, What is Form 8332 Release Revocation of Release of Claim to best sale, IRS form 8332. Non Custodial parent can claim child if custodial best sale, What is the Tax Dependency Exemption and Who Should Get It best sale, Who Claims A Child On Taxes When There Is Shared Custody best sale, Which Divorced Parent Gets to Claim the Kids in Minnesota Taxes best sale, Form 8332 IRS Tax Forms Jackson Hewitt best sale, What Happens When Both Parents Claim a Child on a Tax Return best sale, If I Pay Child Support Can I Claim My Child On Taxes best sale, What is child support and how can I request it AS USA best sale, Dependency Exemptions for Separated or Divorced Parents White best sale, IRS Form 8332 How Can I Claim a Child The Handy Tax Guy best sale, IRS Form 8332 Fill Out Printable PDF Forms Online best sale, Determining Household Size for Medicaid and the Children s Health best sale, Form 8332 In Depth Guide 2024 US Expat Tax Service best sale, Child Tax Credit How it affects joint custody arrangements best sale, Do You Have to Claim Child Support on Taxes best sale, 1 Money Talks Have You Heard Promote the Earned Income Credit best sale, What Rights Do I Have As A Non Custodial Parent best sale, Non Custodial Parent Statement Sample pdfFiller best sale, Non custodial parent form Fill out sign online DocHub best sale, What if I am separated or divorced What if I have joint custody best sale, CP Tax Accounting Services best sale, How to know if you re receiving the right amount of child support best sale, Who Claims the Kids on Their Tax Return best sale.

Non custodial parent claiming child best sale

- non custodial parent claiming child

- non custodial parent definition

- non custodial parent financial responsibilities

- non custodial parent form

- non custodial parent health insurance

- non custodial parent login

- non custodial parent login tx

- non custodial parent moving out of state

- non custodial parent meaning

- non custodial parent not paying child support